Can You Become Addicted To Borrowing Money?

It is hard to imagine but it is creepy easy to become addicted to borrowing money. Addiction to taking out loans is becoming more and more popular among bank customers. At the beginning it looks very innocently, but as time goes by, loan becomes more difficult to pay back, debt grows, and it drains all the energy from you. Sometimes, it is difficult to notice the moment when you start to become dependent on external sources of financing. What are the symptoms of addiction and how to fight such a problem? We answer!

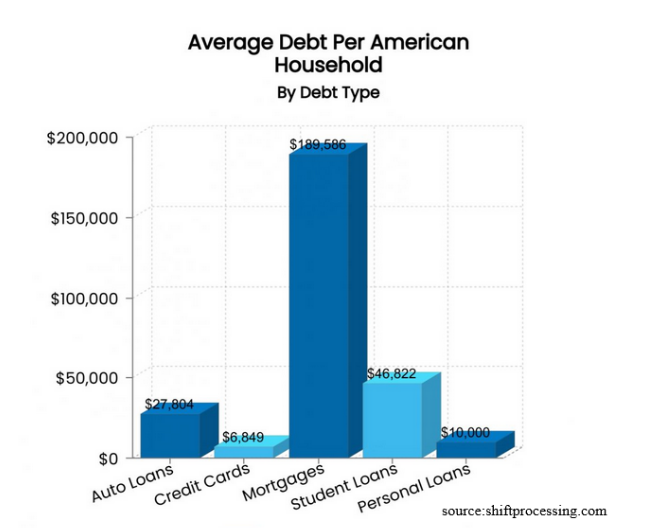

According to the information provided by the website www.shiftprocessing.com “about 80% of Americans have some form of consumer debt, and the average American has $38,000 in debt excluding mortgage debt. Owing money just seems to be a way of life for Americans, as collectively we have $14 trillion in debt. That amount is climbing ever higher. Consumer debt can be broken up into 4 main categories: mortgage debt, auto loans, student loans, and credit card debt. Unpaid medical bills and expensive medical costs are quickly contributing to debt that Americans currently carry.” (source: www.shiftprocessing.com)

Is it Possible to Become Addicted to Loans?

Addiction to taking loans is not as rare as it may seem, but just because you take a commitment does not mean that you have a problem. An addiction occurs when you make decisions about your next loan under the influence of emotions, and your thoughts still revolve around bank offers.

Moreover, you try to hide your acts in front of trusted people, and with each subsequent loan you find it more and more difficult to deal with the repayment of the debt. People who have failed to solve problems in other aspects of their life are particularly vulnerable to become addicted to external sources of money.

Often, engaging in commitments is to divert attention from other hardships and at the same time provide emotions that are missing in everyday life. Unfortunately, such motivation is often a simple way to become addicted and, consequently, to fall into a debt spiral.

You may be interested in other our articles: How to get out of vicious circle of payday loans, or how to use budgeting for controlling your finances?

Addiction to Loan – How Does it Develop?

Dependence on borrowing usually increases over time, and with each subsequent commitment the symptoms intensify, eventually making yourself a loan addict. What symptoms a loan addiction display? You should be worried if most of the symptoms below refer to you:

-

-

- You take loans one by one, often to pay off the previous one,

- You are constantly searching the offers of loan companies and giving up other activities in order to have more time for it,

- You look for the reason and justify the excuses just to take out another loan,

- You find signing a credit agreement quite pleasurable,

- When calculating how many commitments you have currently contracted causes problems,

- You become indebted just to buy goods you do not need,

- You feel a little bit of a humor if your loan request is turned down,

- You become depressed when you cannot request for a loan,

- You hide information about your loans from your relatives,

- Your difficulties in paying back accumulate and you struggle to execute daily duties,

- You have increasing difficulty in controlling tasks at work,

-

What Are The Causes of Loan Addiction?

The causes of loan addiction may be various, but the source of problems is most often associated with emotional deficits. An addicted person does not take loan because of the real value of the loan, but to deal with the difficult emotions that arise.

These can be, for example, fear of poverty, helplessness, and low esteem. Taking a loan gives such a person a false sense of taking control of their own life which only lasts until they have funds in their account. In order to feel the same emotions again, such a person convince himself to take another loan, and this is a straight way to fall into a debt spiral.

Other addictions may also be an indirect cause of loan addiction. Often, loan is supposed to provide funds to finance the needs of an alcoholic, drug addict, gambler, or shopaholic. This is particularly common if the addiction threatens to cause job loss, and thus also the source of funding for drugs. In such a situation, the addict is ready to take even quite a large loan to avoid dealing with the lack of alcohol or drugs.

How to Help a Person Who is Addicted to Loans?

Helping an addict is not the easiest thing to do, but if someone close to you is having more and more difficulties in managing his/her loans, it is worth trying to help such a person. If you have rational assumptions that you might become to the circle of addicts, you should also seek help. What can be done in such a situation?

Therapy For Loan Addicts

If the addiction to credit already has a significant impact on your financial situation, therapy will be the best option. A credit addiction is exactly the same addiction as alcoholism or drug addiction. At the beginning it is our weakness which we try to satisfy with money, but when we lack money it turns into an obsession and in such a situation it is just one innocent step to become addict.

Depending on your situation, individual or group therapy may be helpful. During this therapy, you can come to the real causes of addiction and learn healthier coping patterns.

Incapacitation of a Person Addicted to Loans

The powerlessness associated with a loved one taking out loans sometimes encourages to consider the incapacitation of an addict. In practice, it is the deprivation of an adult of his or her right to legal acts, which results in the invalidity of the contracts he or she signs.

However, in order to incapacitate anyone, it is necessary to go through a very difficult trial and prove that the person is:

- Is psychotic,

- Suffers from mental retardation,

- Has mental disorders,

- Is not capable of creating logical assumptions.

Such an application can be filed to the court by:

- Spouse,

- A relative in a straight line,

- Siblings.

However, the decision to file an application at the court should be a least resort. Such cases can last for years and for obvious reasons have a terribly negative impact on family relationships.

Consumer Bankruptcy of a Person Addicted to Loans

A declaration of consumer bankruptcy is a solution of people who already have problems with a bailiff. If the court accepts the bankruptcy petition, all bailiff’s executions will be stopped and the interest on the debts will not be charged constantly. The judgment may sometimes result in the cancellation of the remaining obligations to pay.

Consumer bankruptcy is obtained through the courts, but the process is quite tedious. In order for the case to be concluded with a verdict in favor of the applicant, it must be shown that the situation in which he found himself in debt was not dependent on him.

If somebody has led to it by making a deliberate choice of taking credits without being able to repay them, there is no chance of winning. The courts agree to declare bankruptcy most often if: there is a sudden loss of job or a serious illness that makes it impossible to earn money.

Financial Education

Whatever the causes of addiction, it is essential to broaden your knowledge of loan-related economic knowledge. It will give you a chance to realistically assess the cost of loan and the risk that goes with it.

Fortunately, such knowledge can be obtained more and more often for free, for example by studying articles on financial portals like – WorldPaydayLoan.

Is a Consolidation of Loans a Good Way Out of Debt?

If your financial situation is not yet so bad and your liabilities are not overdue, a consolidation loan may be a good idea.

It is no replacement for therapy, but it will make it easier to know how much loans you have taken out, and it will allow to better manage your home budget. It will also give a real chance to negotiate a lower monthly loan installment, which will not be so difficult to pay.

To Sum Up

The mechanism of the present world is created in such a way that it is difficult to function in this machine without money, because money is both its fuel and foundation. When a person does not have money, he or she loses the reasoning about his or her weaknesses which were uncovered in difficult financial moments; in such situations, a person thinks about the quickest and easiest way to satisfy his or her weaknesses – another loan. A short-term fix is often an ineffective solution and a person going in the direction of addiction will still repeat the same mistake. Financial loans are help, not a lifestyle. By putting ourselves in a position of failure, we lead ourselves to a situation where weakness transforms into subjective normality and then we are even able to accept our addiction for a while, because it is comfortable. As in most cases, an addicted person arranges his/her own hierarchy of values in such a way that she/he does not notice being already an addict. Everything outside and inside is arranged for a perfect environment nurturing an addiction. The most important approach to such a person is to be able to impose the awareness of the possibility of living without an addiction and where to seek help.

Financial education, therapies for addicts, stepping out of the comfort zone, being honest with loved ones, desire – the best first step towards a brighter future.